Investors often experience election year jitters, especially when it is a Presidential election year. Strong political feelings can cloud otherwise rational judgment on long-term investment strategies. We often say that the market does not like uncertainty, and there is plenty of uncertainty in closely contested presidential elections.

Every four years, optimistic sloganeering vies with fearful predictions as each side seeks to get a leg up with voters. Looking over the last 100 years, from Herbert Hoover’s underwhelming “Who but Hoover?” and Franklin Roosevelt’s more optimistic and tuneful “Happy Days are Here Again”, campaigns have tried to convince the public of their candidate’s successful plans for the country and the economy.

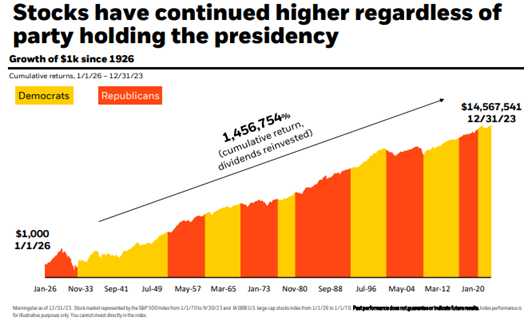

The good news for investors is it doesn’t really matter which party’s candidate is elected president. Stocks have risen dramatically over the long term under both Republican and Democratic administrations. True, there have been sharp, painful selloffs, most notably during the Great Depression under Hoover and the Great Recession under George W. Bush, but over the course of time, markets have produced tremendous returns as the following chart shows (all charts are from BlackRock):

The U.S. economy is huge and hard to predict. Unless it is in response to a major financial crisis when everyone agrees to act together, it is difficult to pass and enact legislation that would have a material economic impact. Companies attempt to grow and maximize shareholder value no matter who is in office, so it pays to separate your political beliefs from your investment planning.

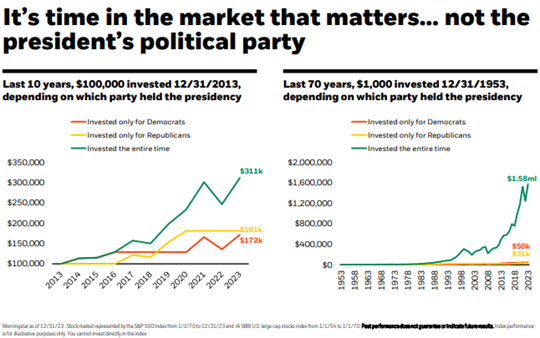

Let’s look at how much of that cumulative return you would have given up if you only invested when your preferred party was in power. The 1,456,754% return shown in the above chart is a little hard to wrap one’s head around so we’ll concentrate on dollar amounts over different time periods. The following chart shows what would have happened if you only invested when your party was in office compared to whether you remained apolitical and stayed invested. Starting with $100,000 in 2013, those who only invested when a Republican was president would have seen their portfolio rise to $181,000, while those investing only when a Democrat was president would have $172,000. Those who stayed invested no matter which party was in power would have seen their portfolios soar to $311,000. The numbers are even more impressive when looking at the last 70 years. Over that period, Democrats who invested $1,000 would have earned marginally more than Republicans, but investors who stayed in the market the entire time would have earned $1.5 million more than either of them.

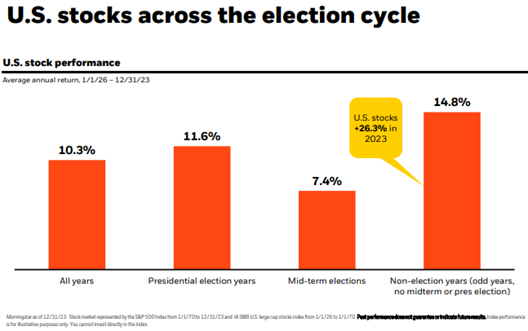

During election years when uncertainty is at its highest, it also pays to stay invested rather than sit on the sidelines until the results of the election are known. The chart below shows that, going back to 1926, Presidential election years have seen better than average returns in the stock market. Stocks have performed best during years when there is no Presidential or midterm election (up 14.8% on average), but Presidential election years have also produced attractive returns (11.6%).

Looking even further at results by quarter, the greatest returns in Presidential election years have happened in the third quarter with stocks rising 6.2% on average during the July to September time period. This is, of course, before the election in November, so if you waited until after the election to get back into the market, you would have missed most of the gains for the year.

Separating political views from investments is the smart thing to do to achieve your financial goals. Regardless of your political affiliation, history shows that it’s best to be an Independent when it comes to long-term investing success.

Social Media