Required Minimum Distribution rules used to be simple enough that clients knew when they were subject to the rule. Confusion around Required Minimum Distribution (RMD) rules started in 2019 with the passing of the Secure Act. Additional changes over the past four years have prompted many questions from clients. In this article, we’ll summarize the current rules, what is different for 2023, and what you should do if you have questions.

Current Required Minimum Distribution Rules

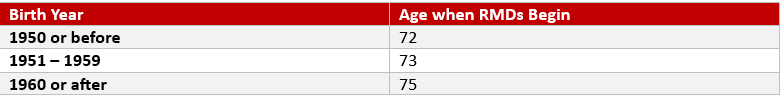

- Traditional IRA RMDs must be met as outlined in the below chart

- Inherited IRA RMD rules have not changed for IRAs inherited prior to 2020.

- Prior to the SECURE Act, beneficiaries of Inherited IRAs had the option to “stretch” the distributions over their own life expectancy, allowing for potentially smaller annual distributions and longer tax-deferred growth.

- IRAs inherited in 2020 or later, most beneficiaries must fully distribute the account within 10 years. In addition:

- If the original IRA owner was taking RMDs during their lifetime, an annual RMD may be required. However, this requirement is currently waived through 2023.

- If the original IRA owner had yet to begin taking RMDs, annual RMDs are not required.

So how did we get here? Prior to the passing of the SECURE Act at the end of 2019, the age to start taking RMDs was 70 ½ years old. The Secure Act changed the RMD rules for anyone other than a spouse who inherited an IRA in 2020 or later. The major change requires non-spouses to take all money out of the Inherited IRA within 10 years. My partner, David Greene, put together a great summary article of the SECURE Act.

The Secure Act 2.0 clarified a few points and materially changed the RMD age to 73 starting in 2023, then back further to age 75 beginning in 2033. My colleagues, Brian Jones and Parker Trasborg, wrote an article highlighting the changes.

The IRS ultimately waived the new inherited RMD requirement for 2021 and 2022. They also issued guidance that annual RMDs may be due going forward and vowed to clarify the rule. In June of this year, the IRS issued additional guidance that further waived inherited RMDs for 2023 and noted that final guidance should be expected in 2024. Beneficiaries who inherited their IRAs in 2020 and after may be required to take their first annual RMD in 2024. In 2024, anyone subject to an annual RMD would need to take that distribution or face a tax penalty of 25%. Of course, we’ll continue to monitor the situation in case the IRS decides to change its mind again.

For some clients, it makes sense to take an Inherited IRA distribution this year even though there is no requirement. The 10-year rule still applies, so it’s important to work with your accountant and financial planner to plan for the long-term tax bill that could be associated with the distributions.

With the frequent changes to the RMD rules, our clients have had a lot of questions about their RMDs. At CJM, we handle RMDs for all our managed clients to alleviate the stress of having to keep up with these ever-changing rules. If you still have questions or are uncertain whether you are subject to an annual RMD, please don’t hesitate to reach out; we’d be happy to have a conversation.

Social Media